Before beginning, please note the following:

- Complete each step before continuing to the next

- You will choose up to EIGHT timeslots to meet one-on-one with Alumni in Step 2

- Do not double book yourself – you will see all available times for each alumni, you need to ensure you have not already booked this time with another person

- Do not schedule more than one meeting with a single alumni. It’s important that others get a chance to meet with the alumni they are interested in.

- Calendar events will be sent to your inbox, please save these and ensure you attend as your information from Step 1 will be sent to each alumni following registration.

- If for some reason you do need to cancel a one-on-meeting, please email either our Program Manager, Colleen at cotrieze@umich.edu or our Community Engagement Coordinator, Natalie at nkkeene@umich.edu

- You will receive an email calendar invite after scheduling each one-on-one, please do not to respond to these emails as they are not associated with the alumni.

Step 1: Student Info

Please complete the requested student information below. Submit info and continue on to schedule time slots in Step 2.

Step 2: Choose Eight One-on-One Meetings with Alumni

Listed below are the Alumni that will be participating in the one-on-one speed networking event. Please choose your timeslots by clicking on the Name & Title of the individuals below. There you will find more information regarding the history and experience of each alumni, as well as a link for where to sign up for their sessions. You will need complete this step for each of the alumni you wish to meet with.

Sam Schneider Co-Founder and Managing Partner at Imperium Capital

Sam is the co-founder and Managing Partner of Imperium Capital. He is responsible for the overall strategy, sourcing, financing, and operations for the company. Prior to founding Imperium in 2010, Sam was a director at Eastern Consolidated where he successfully completed over $750 million of transactions. Prior to joining Eastern Consolidated, Sam was director of acquisitions for KMG Partners, a NYC based developer. Sam graduated from the University of Michigan with a degree in Political Science and was a member of the varsity baseball team.

Joel Kamstra Principal at Frisia Group

Joel Kamstra is the Managing Partner of Frisia Group, a real estate development and asset management company in Grand Rapids, MI. Prior to forming Frisia Group he was a founding member of Cherry Street Capital where he led opportunistic development and acquisitions. Before Cherry Street Capital, Joel worked in investment sales at Grubb & Ellis. He earned an MBA from the University of Michigan’s Ross School of Business and a BS from Calvin University.

Nevan Shokar Vice President of Basco

Nevan Shokar, a resident of the Brush Park neighborhood in Detroit, and graduate of the University of Michigan’s Ross School of Business BBA program, is the Vice President of Real Estate at Basco. His responsibilities include leading the firm’s development efforts, leasing, financial analysis and reporting, Excel modeling, and government relations. Nevan has spent over a decade sourcing, acquiring, developing, and financing over $4 billion of real estate transactions across the globe. Prior to Basco, he worked in economic development alongside the Mayor of Detroit to structure commercial real estate transactions, placed investments for the CALPERS, and worked for the largest owner of health care assets in the world.

Alexander Glassman Managing Director at Fundamental Advisors

Alexander Glassman is a Managing Director at Fundamental and a member of the Investment Team. Mr. Glassman primarily focuses on affordable and workforce housing investments. Prior to joining Fundamental in 2012, Mr. Glassman was an Associate in the Corporate Finance Department at Lehman Brothers Holdings Inc. Mr. Glassman was engaged by Alvarez and Marsal’s Restructuring Group to assist in the wind down of Lehman’s post-bankruptcy assets. Mr. Glassman received his B.B.A. from the Stephen M. Ross School of Business at the University of Michigan.

Jubek Yong-Bure Principal, Urban Planner at Jumi Consulting Group

Jubek has managed and closed multimillion dollar real estate transactions for multifamily and single-family new construction and acquisition rehab deals using low income housing tax credits (LIHTC), new markets tax credits (NMTC), grants, and an array of public and private capital. Jubek has managed key project tasks including feasibility analyses, budget development and management, and city review processes. Jubek has also initiated partnerships with civic, health, community, and faith-based organizations to implement social justice initiatives throughout the nation.

Jubek has a Bachelor of Arts in Sociology with a minor in Community Action Social Change from the University of Michigan, and a Master in Regional Planning with a concentration in Economic and Community Development from Cornell University.

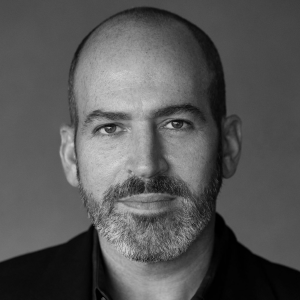

Gregory Nalbandian Senior Managing Director at Jones Lang LaSalle

Greg is a senior managing director in the New Jersey office of JLL Capital Markets, Americas. He joined JLL as part of the HFF acquisition and has more than 30 years of experience in the commercial real estate industry. He focuses primarily on debt and equity placement transactions throughout New Jersey and the Tri-State area. Throughout his career, Greg has completed more than $10 billion in transaction volume.

Greg started working at HFF in February 2017. Before

that he was with NorthMarq Capital, LLC, where he worked as a senior vice president and managing director, starting in 2005. In this role, Greg was responsible for leading the New Jersey regional office and was consistently a top producer nationally, working on a variety of debt and equity placements. Prior to NorthMarq, he was a principal at The Schonbraun McCann Group, LLC, a leading real estate-dedicated advisory firm in New Jersey. Greg began his commercial real estate career with O’Connor Capital Partners, a real estate private

Todd Benson Principal, Development at PEBB Capital

In his role, Mr. Benson specializes in maximizing value through active management and innovative problem solving. Over the course of his career, Mr. Benson has successfully completed more than a billion dollars in real estate transactions and has played a pivotal role in the acquisition, financing, construction, operations and leasing of those assets. His unique operational skillset is marked by a combination of an institutional background and extensive “on-the-ground” management experience. Prior to his current position, Mr. Benson served as principal of Collegium Capital, now a subsidiary of PEBB Capital. Benson received his bachelor’s degree in political science from the University of Michigan and his master’s in finance and development from New York University, where he served as adjunct professor in finance and development in the university’s Real Estate Institute.

Shana Weiss Vice President of Bloomfield Capital

Shana Weiss is a Vice President at Bloomfield Capital and focuses on sourcing and underwriting real estate debt opportunities. Prior to Bloomfield, Shana was a Director at ValStone Partners, a private equity firm located in Birmingham, MI focused on opportunistic and distressed investments. Shana was responsible for sourcing, underwriting, and executing new acquisitions and had a focus in senior housing. She has experience across a variety of asset types including fee simple commercial real estate, non-performing and sub-performing loans, and distressed municipal bonds. Shana is a graduate of the University of Michigan Ross School of Business and a Chartered Financial Analyst (CFA) Charterholder.

Clarke Lewis President of The Platform

Named President in July 2023, Clarke oversees all aspects of development including acquisitions, entitlements, construction, leasing and asset management. He also provides strategic direction and oversight of company operations.

Clarke has extensive knowledge of urban, mixed-use development projects and prides himself on his ability to build collaborative relationships with key stakeholders. Since joining The Platform in 2016 Clarke has led development of the Detroit Pistons Performance Center and The Boulevard, a 231-unit multi-family development. He was a key player in forming the company’s partnership with the Michigan State University endowment on the historic Fisher Building and Piquette Flats projects and will lead future mixed-use development surrounding the Fisher.

Gregg Mayer CEO of Bisnow

Gregg Mayer is the CEO of Bisnow LLC. Bisnow is a private equity owned industry leading B2B platform informing and connecting the commercial real estate industry primarily through news and events via a hyper-frequent and hyper-local business model. Bisnow reaches more than 11 million readers and hosts approximately 350 events each year in 46 local markets across the U.S., Canada, the United Kingdom and Ireland. At Bisnow, Gregg oversees all non-sales operations worldwide, including all strategic efforts and M&A initiatives. Gregg also spearheads the finance department and serves as the principal liaison with the key stakeholders. Gregg served in a similar capacity at Bonded Services, a private equity led global leader in physical and digital storage solutions for the media and entertainment sector, until the business was ultimately sold to a strategic buyer in 2017. Previously, Gregg worked at Alpine Capital Group, a private equity fund and advisory group, which he joined in 1998. At Alpine, Gregg focused on the media, advertising, education and business services verticals. Gregg graduated from Ross School of Business as BBA in 1996.

Please note Gregg Mayer is only available from 9am-10am

Justin Heller Managing Director at Angelo Gordon

Justin Heller joined Angelo Gordon in 2011 and is a Managing Director focusing on underwriting, sourcing, portfolio management and credit monitoring for the firm’s net lease real estate strategy. Prior to joining Angelo Gordon, Justin worked for FTI Consulting, a global business advisory firm focused on restructuring, where he was responsible for advising secured and unsecured creditors through complex bankruptcies. Justin is a Certified Insolvency and Restructuring Advisor (CIRA). Justin received a BBA from the Ross School of Business at the University of Michigan.

Todd Rosenberg Cofounder & Managing Principal at Pebb Capital

Since founding Pebb Capital in 2013, Todd has strategically led the company in acquiring, developing, and investing in over $2 billion in asset value in various positions across the capital stack and in diverse U.S. markets. As Co-Founder and Chairman, he oversees planning, process, and execution of all Pebb Capital ventures in major sectors, including retail, office, hospitality, multifamily, student housing, and mixed-use. Todd’s experience in all phases of the investment cycle has established Pebb Capital as a vertically-integrated real estate and private equity firm with the flexibility and sophistication to perform in any market, asset class and dynamic condition.

Prior to Pebb Capital, Todd served as co-chief financial officer and in-house counsel for Pebb Enterprises, where he was instrumental in growing his family’s multigenerational real estate business from a local real estate/manager to an institutional-quality real estate development and investment firm.

Karolina Lutrzykowska Acquisitions Analyst at Agree Realty, Founder of Women in Real Estate club at the University of Michigan

Karolina Lutrzykowska is the founder of Women in Real Estate at the University of Michigan, a club dedicated to educating and empowering women and gender minorities in both residential and commercial Real Estate.

Today, Karolina is a Senior Analyst of Acquisitions at Agree Realty Corporation, a publicly traded REIT primarily engaged in the acquisition and development of properties net leased to industry-leading, omni-channel retailers. Through deal origination and fostering relationships with brokers, sellers, and developers, she plays an integral role in expanding Agree’s 2,000+ property portfolio.

Lauren Leach Managing Director of Real Estate Strategy at KPMG

Lauren Leach is a global real estate strategist who specializes in complex lease negotiations, lease restructuring, and maximizing real estate portfolio value. She has over 15 years of experience in executing real estate strategies in both healthy and distressed environments. Lauren has significant experience in successfully restructuring leases for both corporate and CMBS clients. She actively negotiated over 12,000,000 square feet of leases representing over $1,000,000,000 in value.

Prior to joining KPMG, Lauren worked at a turnaround and restructuring firm and a real estate investment company; always focused on real estate. She brings nearly 20 years of real estate experience representing landlords and tenants, commanding a unique perspective to the negotiating table.

Andrew Selinger Chief Investment Officer of Oxford Companies

Andrew Selinger serves as the Chief Investment Officer at Oxford, with primary responsibilities in investor relations, asset management, and corporate and portfolio finance. He is also involved in Oxford’s development initiatives, as well as involvement with Oxford’s legal department, Board of Advisors, and executive Leadership Team.

Andrew began his real estate career as an intern in 2009 at Oxford Companies while attending the University of Michigan. After graduation, he was hired full-time and has since been promoted five times, each time to a position that did not previously exist. Andrew has played a key role at Oxford, which has grown from 16 to over 100 employees since he joined the company.

Komal Sankla Principal at Blackstone

Komal is a Principal on the Blackstone Real Estate Debt Strategies (BREDS) team, Blackstone’s real estate lending and debt investment business. Komal is involved in sourcing, underwriting, negotiating and structuring senior loans, mezzanine loans, preferred equity and other debt investments across all asset types and geographies throughout the U.S.

With over $67B in AUM, BREDS is one of the largest US-based non-bank commercial real estate lenders and is part of the broader Blackstone Real Estate platform. Blackstone Real Estate is the largest owner of commercial real estate in the world and the largest business within Blackstone, which has $1 trillion in assets under management.

Andrew Dunlap Senior Vice President, Acquisitions & Investments at REDICO

Andrew Dunlap is the Senior Vice President of Acquisitions and Investments at REDICO, and serves on its Executive Committee. Andrew has been with REDICO since October 2007, where he started as an analyst working in operations and finance. In his current role, Andrew is responsible for sourcing, underwriting and closing new investments, including acquisitions and developments. Additionally, he focusses on sourcing, securing and managing REDICO’s relationships with institutional capital partners, lenders, operating partners, brokers and other sources of deal flow. While at REDICO, Andrew has sourced, closed or has under-contract transactions valued at more than $1.5 Billion.

Prior to his current role, Andrew worked on the Asset Management team at REDICO where he strategically guided a portfolio of assets valued at more than $300 million. In this role, Andrew was responsible for leasing oversight, re-financing, re-capitalizing and dispositions to maximize property and portfolio value.

Richard Broder CEO of Broder Sachse Real Estate

Richard Broder is a founder and one of the partners of Broder Sachse Real Estate. In his current role, he is responsible for the company’s strategic activities. Under his leadership, Broder Sachse Real Estate has grown from a start-up business to a full-service third-party property management, acquisition, and development company. Having sold the third-party business in 2017, Broder Sachse Real Estate now manages its portfolio, which currently has an AUM of about $350 million.

Rich is a graduate of the University of Michigan, where he graduated with a Bachelor of Arts degree in Urban Studies. Upon graduation, he joined Farbman Stein and Company as a property manager and became Executive Vice President of Farbman Stein.

Derric Scott CEO of J29:7 Planning & Development Corporation

Derric Scott is the Founder and CEO of J29:7 Planning & Development Corporation. Most recently as the former CEO of East Jefferson Development Corporation he was responsible for developing and overseeing a 30 year, $680+ Million Master Development Plan on Detroit’s East Side with more than $68M+ in investment completed through the first 4 years. Brought on to start the organization as the for-profit subsidiary of a non-profit in 2016, he was responsible for growing the balance sheet to more than $13.7 Million in assets by the end of 2021.

With a background in affordable housing, urban planning, community and economic development, Derric’s focus has been on Inclusive Development and ensuring that development directly benefits those in the communities surrounding it. Driving more than $1.5 Billion in investment during his career, he has spent his life dedicated to education, mentorship, and economic and community development activities in challenged urban environments. Through his work, more than 1300 Detroit Metro High School students have been given the opportunity to pursue higher education.

Kristin Mixon Vice President of Plante Moran Real Estate Investment Advisors

As a Vice President with Plante Moran Real Estate Investment Advisors (REIA), Kristin conducts financial, feasibility, and economic impact analyses of potential real estate transactions and development projects. Kristin also works with our project management team to help K-12 clients plan, source, and execute capital improvement projects within their districts.

Prior to joining Plante Moran REIA, Kristin served in the U.S. Army for eight years as a helicopter pilot and officer. After her Army career, Kristin earned her Master of Business Administration degree and Real Estate Development Certificate from the Ross School of Business at the University of Michigan, during which time she was selected as a Goldie Scholar by the Goldie B. Wolfe Miller Women Leaders in Real Estate Initiative, a program that supports women working in commercial real estate.

Myles Hamby Senior Development Manager at The Platform

As Senior Development Manager for The Platform, Myles leads projects from concept to completion, including property acquisition, design, construction, leasing, and marketing for both residential and commercial projects in Detroit. Since joining The Platform in 2017 he has led several of the Platform’s high-profile residential and retail developments, including Woodward West, a $60 million new construction residential development that opened in Midtown, and Baltimore Station, a $9 million renovation of a 100-year-old building in New Center. He is also responsible for office and retail leasing at several properties.

Prior to joining The Platform, he worked on food accessibility at Eastern Market Corporation. Myles holds a Master’s in Urban Planning from the University of Michigan and Bachelor’s in Global Studies from UCLA. When not working on real estate development, Myles enjoys cultivating his urban farm with his wife and three children on Detroit’s eastside.

David Roodberg President of Menkiti Group

David Roodberg is currently President of Menkiti Group, a minority owned development firm based in Washington DC with a portfolio of 1.4 million square feet and a pipeline of $1.8 Billion. Prior to Menkiti Group, David served as CEO of Horning for 20 years. Horning is a real estate development and management firm with over 4,000 multi-family units and over 500,000 square feet of commercial. During David’s tenure at Horning, two of the company’s projects were recognized by the Washington Business Journal for its Community Impact award. Prior to Horning, David was Executive Vice President of Combined Properties an owner of over 4 million square feet of shopping centers.

In addition to his corporate positions, David has had a number of non-profit, governmental and educational roles. David served as Chairman and is a current Board member of the Washington Housing Conservancy, and on the Boards of Greater Washington Community Foundation and Martha’s Table. Previously, David was appointed by the DC Mayor to the Housing Production Trust Fund Advisory Board and Comprehensive Housing Task Force. David is on the Advisory Board and previous Professor for the University of Maryland Masters in Real Estate program.

Sara Hammerschmidt Director of Sustainable Development at THRIVE Collaborative

Sara Hammerschmidt is Director of Sustainable Development for THRIVE Collaborative, an Ann Arbor, MI based real estate development, design, building and consulting firm dedicated to creating the life enhancing communities and cities needed for the 22nd Century. Previously, Sara was a Senior Director at the Urban Land Institute where she worked as part of the Building Healthy Places Initiative, developing content and programs focused on improving public health, sustainability, and social equity through changes to the built environment. Sara has spoken about how real estate development can improve health outcomes and the role of developers and other land use professionals in improving health and sustainability at several national conferences.

Sara holds an M.S. and Ph.D. in Community and Regional Planning from the University of Texas at Austin, and a B.S. in Industrial Operations and Engineering from the University of Michigan. She has served on the Ann Arbor City Planning Commission since 2019.

Bill Bubniak Executive Vice President at NAI/Farbman

In addition to his roles at the University of Michigan, Bill is currently an Executive Vice President at NAI/Farbman, where he has been since joining their team in January 1988. He oversees the Investment Sales Division of the brokerage Department. He is also a member of the Leadership Team of the Firm. Bill specializes in the investment in and sale of turnaround properties and structuring deals for user/buyers to purchase for their own business.

Bill has been involved in a variety of types of real estate investments including office buildings, net leased transactions, hotels, industrial buildings, shopping centers, and apartment projects. He was previously the chairperson for the NAI Investment Council for seven years.

Prior to joining NAI/Farbman, Bill was employed by the law firm of Clark, Hill (formerly Hill, Lewis) as an attorney where he specialized in tax and real estate law.

Jason Jarjosa Managing Partner, Bloomfield Capital

Jason F. Jarjosa is a Partner and co-manager of Bloomfield Capital. Prior to Bloomfield, Jason was Vice President of ValStone Partners, a $500 million private equity firm located in Birmingham, MI focusing on opportunistic and distressed investments. During this time, Jason led ValStone’s investment team in acquiring notes and originating bridge loans across all sectors of real estate. Jason started his career as an investment banker at Schroders (now Citigroup) in New York. Jason recieved his BBA and MBA from The Stephen M. Ross School of Business at the University of Michigan where he graduated with distinction.